Weyay - National Bank of Kuwait

Built from the ground up in just twelve months, Weyay is designed to serve the financial and lifestyle needs of young Kuwaitis. The new banking platform is part of NBK’s wider digital strategy to provide customers with cutting-edge technology and tools.

The name Weyay (‘with me’) was selected to reflect NBK’s personalised approach to digital banking, and the logo was created to signify progression and growth.

Weyay’s brand identity is brought to life through unique features, initially launching with fast digital onboarding, fully digital account management and allowance transfer.

🏅Winner of “Outstanding Innovation in Mobile Banking” at Global Finance’s Annual Innovators Awards for 2022

The challenge

The Middle East banking system is going trough a rejuvenating, with major banks across the region racing to deliver a world class customer experience into the youth market. NBK wanted something designed to serve the financial and lifestyle needs of young Kuwaitis.

The results

The Weyay app was launched on Google play and Apple Appstore in December 2021, enabling fully digital, instant and paper-free account opening. Customers can download the app and sign up at their own convenience from wherever they are, and securely verify their identities using Kuwait Mobile ID or scanning their Civil ID in the Weyay app.

The opportunity

As the country’s first fully-digital bank, Weyay’s suite of financial services will be built to help young people feel empowered to manage their finances and feel supported in making decisions.

Design principles

Clarity

A key principle in designing a bank app

This means that the app should be easy to understand and navigate, with clear and concise labels, instructions, and feedback.

Simplicity

Few steps, big flows

The app should be simple to use, with minimal steps required to complete a task.

Integration

Integrate, simplify, and conquer.

The app should integrate well with other apps and platforms, such as mobile wallets and online banking portals.

Phase 2: Loans

This new loan application process was built after the MVP version of the app had great success at launch, further solidifying NBK's commitment to providing their customers with the best possible experience.

NBK, wanted to launch a streamlined loan application process, allowing users to apply and get approved in record time. The goal of this innovative new app is to increase revenue and loan applications for NBK, providing their customers with a fast and convenient way to access the financing they need.

With the new loan application process, users can easily complete and submit their loan application using their smartphone or tablet. The app utilizes advanced technology to verify their identity and provide instant pre-approval, saving users valuable time and reducing the stress often associated with traditional loan applications.

In addition, the app also offers a range of other features designed to simplify the loan application process and improve the customer experience. Users can track their loan application status, receive real-time updates, and securely access their loan information and documents from anywhere, at any time.

Facilitating loan discovery

Sitting beneath the total holdings amount, featured cards encourage users to apply for loans. These cards provide information on the different loan options available to users and highlight the benefits of taking out a loan.

By making loan options easily accessible and visible on the home page, the app helps to encourage users to apply for loans, which is beneficial for both users and the bank.

Steps list and financial commitments check

Step 1 of the Loan Calculator App includes several key functionalities that help users prepare for loan application. Firstly, the app lists the necessary steps required to complete the loan application process, providing users with a clear understanding of what they need to do. This helps to ensure that users are well-informed and can easily follow the process from start to finish.

Additionally, the app also checks the user's financial commitments, including existing loans, credit card balances, and other financial obligations. This information is used to assess the user's financial capacity and determine their eligibility for a loan. By checking these financial commitments, the app helps users to understand their current financial situation and assess whether they are ready to apply for a loan.

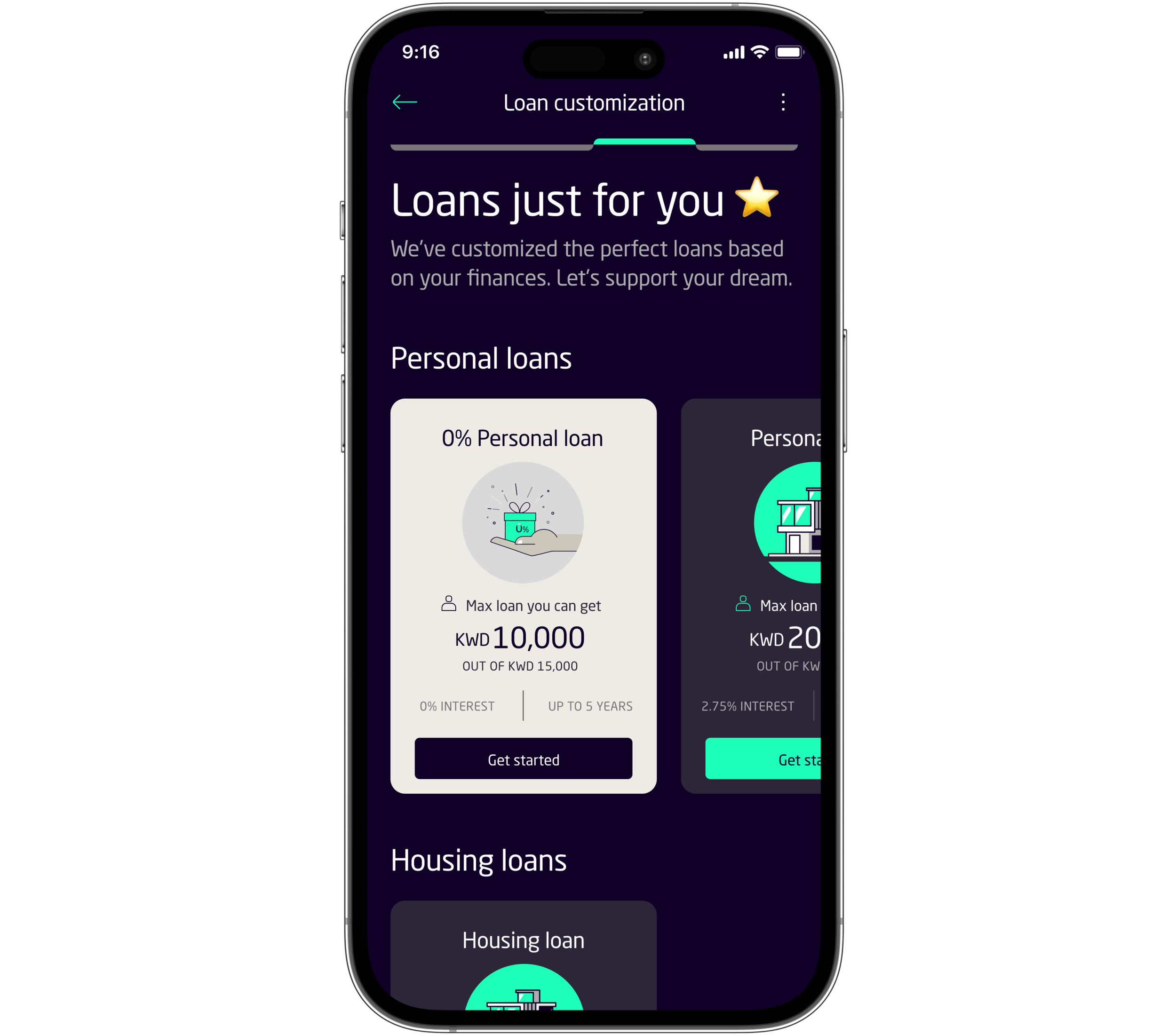

Personalised loan offers

The app calculates personalised loan options based on the user's financial information, creating customised loan offers that meet their unique needs. This supports the user's dreams and helps turn them into reality, with high likelihood of loan approval.

The loan calculator

This loan calculator allows users to easily estimate the cost of a loan. With the ability to adjust the loan amount and/or loan duration, users can see the total monthly instalment amount change in real-time. Additionally, users have the option to add insurance to their loan, which will also affect the total cost of the loan. The end amount, including all additional costs, is displayed in the summary section. For those who need more flexibility, the calculator also includes a feature to delay the first payment. With this loan calculator, users can quickly get a clear understanding of their loan costs and make informed decisions.

Docs upload and summary

This process allows users to securely upload the necessary documents required for loan application, such as proof of income and identification, this helps users to ensure that they have all the necessary information and documentation required for loan application, and provides a quick and convenient way to submit this information.

The summary page provides a comprehensive overview and summary of the entire process that users have completed up to this point. This page serves as a one-stop-shop for all the information that the user has provided until now.

The approval process

Here users can track the progress of their loan application in real-time, also during the loan approval process, the app may request additional documents or signatures from the user.

By providing users with real-time updates on the status of their loan application and clear instructions on what is required at each stage, the app helps to simplify the loan approval process and provide peace of mind to users.

Manage your loan

Once the loan is approved, the Loan Calculator App provides users with a sleek and user-friendly interface to manage their loan. On this page, users can see how long their loan is for and how much of the loan is left to be paid. They can also make payments, either partial or full, to pay off the loan as soon as they are able.

Additionally, users can reschedule loan payments if needed, making it easier to manage their finances and ensure that they can stay on top of their loan payments. This feature helps to provide flexibility and peace of mind for users, as they can adjust their loan repayment schedule as needed.

Furthermore, the app provides users with access to all loan documents, including the loan agreement, payment schedule, and any other relevant documents. This allows users to easily review and track the details of their loan, and provides a convenient way to access the information they need.